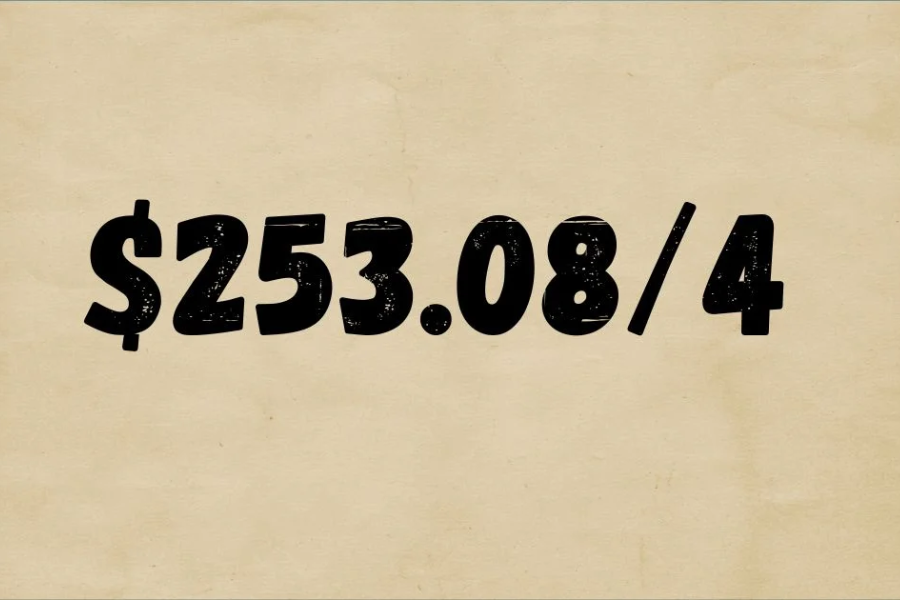

Understanding the Value of $253.08 in Personal Finance

In the ever-changing landscape of economics, every dollar counts. A specific amount like $253.08 may seem trivial at first glance, but its significance can vary widely based on individual circumstances. This article explores the various aspects related to this figure, examining its implications in personal finance, consumer behavior, and financial decision-making.

The Importance of $253.08

At its core, $253.08 might be just another number in your wallet or bank statement, but it can hold different meanings for different people. For some, this amount could represent a minor expense, while for others, it may be a crucial payment for necessities. Understanding its role in your personal budget is key to effective financial management.

How $253.08 Fits into Personal Budgets

Creating a personal budget is one of the first steps toward achieving financial health. When analyzing a figure like $253.08, it’s essential to determine how it fits into your monthly expenses. For example, if your rent is $1,200 per month, $253.08 could cover a portion of your utility bills, groceries, or even entertainment costs.

When mapping out your budget, consider allocating this amount to various categories such as:

- Utilities: A portion of your monthly bills

- Groceries: Essential food items for a week or two

- Entertainment: A night out or a special event

By examining how $253.08 integrates into your budget, you can make informed decisions about your spending and savings.

The Buying Power of $253.08

Inflation plays a significant role in determining the purchasing power of money over time. The value of $253.08 today may not be the same as it was a decade ago. Understanding inflation helps you grasp how far your money will stretch and its implications for spending and saving.

For instance, back in 2014, $253 could cover a considerable amount of groceries; today, it may only suffice for the basics. Recognizing these changes allows you to adjust your budget and spending habits accordingly.

Saving $253.08: A Small Yet Impactful Habit

Consistently setting aside $253.08 each month can lead to substantial savings over time. After a year, that amount becomes $3,036, which can significantly contribute to your financial goals. Here are a few avenues where those savings could be directed:

- Emergency Fund: Building a safety net for unexpected expenses

- Retirement Savings: Investing for your future

- Vacation Fund: Planning for a much-needed getaway

Learning to save even small amounts consistently can lead to significant financial benefits, helping you achieve your short-term and long-term financial goals.

Investing $253.08 Wisely

Investing is one of the most powerful ways to grow your wealth. If you were to invest $253.08 in a mutual fund with an average annual return of 7%, the potential returns could be substantial over time. The power of compound interest can dramatically change your financial future.

Consider this scenario:

- Initial Investment: $253.08

- Average Annual Return: 7%

- Investment Duration: 10 years

By investing that amount wisely, you could see your initial investment grow significantly, illustrating the importance of starting small when it comes to building wealth.

The Role of $253.08 in Consumer Behavior

Consumer behavior studies often examine how much individuals are willing to spend on various products and services. A figure like $253.08 can represent different things based on marketing strategies and consumer psychology. For example, if a consumer sees a gadget priced at $249, they may perceive it as a good deal, prompting impulsive spending.

Understanding consumer behavior can help you make informed purchasing decisions. Being aware of marketing tactics can enable you to resist unnecessary temptations and focus on what truly adds value to your life.

Financial Responsibility and $253.08

Allocating $253.08 responsibly is a crucial lesson in financial literacy. It highlights the importance of distinguishing between needs and wants. For example, spending $253.08 on the latest smartphone may be seen as a want, while using that same amount to cover necessary expenses like rent or groceries is a need.

Balancing these choices is essential for maintaining financial health. Recognizing what constitutes a necessity versus a luxury can help you prioritize your spending and ensure that your financial resources are directed toward what truly matters.

The Impact of $253.08 on Debt Repayment

If you have outstanding debts, such as credit card balances or student loans, applying $253.08 toward your monthly payments can significantly improve your overall financial health. The quicker you pay off your debt, the less interest you’ll accrue over time, leading to savings in the long run.

For example, if you apply $253.08 to your credit card balance:

- Total Debt: $5,000

- Interest Rate: 15%

- Monthly Payment: $253.08

By prioritizing debt repayment, you can free up more of your budget for saving and investing in the future, ultimately leading to greater financial stability.

Charity and Giving Back with $253.08

Another meaningful way to utilize $253.08 is through charitable giving. Whether you choose to donate to a local food bank or support a global charity, this amount can make a difference. Giving back not only helps those in need but can also provide a sense of fulfillment and happiness.

Research shows that charitable giving can enhance your overall well-being. By contributing $253.08 to a cause you care about, you can positively impact the lives of others while enriching your own.

The Psychological Aspect of Money Management

Understanding the emotional connection people have with money is vital for effective financial management. How you perceive $253.08 can be influenced by your financial history, upbringing, and current situation. Recognizing these factors can help you develop a healthier relationship with money and encourage better financial decisions.

For instance, if you grew up in a financially secure environment, you may perceive $253.08 as a small amount, while someone from a less affluent background might see it as a significant sum. Awareness of these perspectives can lead to more mindful spending and saving practices.

Utilizing $253.08 for Education

Investing in education is one of the most productive uses of money. A course or workshop that costs $253.08 could lead to new job opportunities or enhance your skill set. Education is a long-term investment that pays dividends in the form of better career prospects and personal growth.

Consider allocating $253.08 toward:

- Online Courses: Learning new skills or advancing your career

- Workshops: Gaining expertise in a specific field

- Books: Expanding your knowledge and understanding

By prioritizing education, you are investing in your future and enhancing your earning potential.

Travel Opportunities with $253.08

For those looking to explore the world on a budget, $253.08 can cover a weekend getaway or even a short trip. Understanding the importance of travel and experiences can lead to a more fulfilling life. Exploring new places broadens your horizons and provides a break from routine.

Imagine using $253.08 for:

- Weekend Getaway: A relaxing break from daily stress

- Cultural Experience: Immersing yourself in a different environment

- Adventure Activities: Creating lasting memories

Travel not only offers excitement but also contributes to personal growth and well-being.

The Connection Between $253.08 and Lifestyle Choices

Your lifestyle choices significantly influence how you view and utilize $253.08. If you prioritize luxury goods and experiences, this amount may not stretch far. Conversely, if you adopt a minimalist lifestyle, $253.08 can go a long way in fulfilling your needs and desires.

Evaluating your lifestyle can help in managing your finances better. Ask yourself:

- What do I value?

- How can I align my spending with my priorities?

By making conscious choices, you can stretch your dollars further and enhance your overall quality of life.

Preparing for Unexpected Expenses with $253.08

Unexpected expenses can arise at any moment, making it essential to have a financial buffer. Having an amount like $253.08 set aside can provide a safety net during emergencies, such as car repairs or medical bills. Planning for such situations is a vital aspect of financial stability.

To prepare for unexpected costs, consider:

- Emergency Fund: Saving a set amount each month for unforeseen expenses

- Insurance: Investing in coverage to minimize financial impact

- Budget Flexibility: Allowing room in your budget for unexpected costs

Being prepared for financial surprises can reduce stress and enhance your overall financial security.

Conclusion

In conclusion, understanding the value of $253.08 in today’s economy extends beyond the number itself. It represents opportunities for saving, investing, and responsible spending. By examining its various applications, individuals can make informed decisions that positively impact their financial health. Whether budgeting, investing, or giving back, this amount can significantly influence your life.

In the end, it’s not just about the dollar amount; it’s about how you choose to utilize it in a way that aligns with your goals and values. By recognizing the power of $253.08, you can take meaningful steps toward achieving financial stability and fulfillment.

Facts

- Budget Allocation: $253.08 can be allocated to various expense categories such as utilities, groceries, or entertainment, impacting monthly budgeting decisions.

- Inflation Impact: The purchasing power of $253.08 changes over time due to inflation, affecting how much this amount can buy compared to previous years.

- Saving Potential: Setting aside $253.08 monthly can accumulate to $3,036 annually, contributing significantly to emergency funds or other financial goals.

- Investment Growth: Investing $253.08 at a 7% annual return could lead to substantial growth over time, illustrating the power of compound interest.

- Debt Repayment: Allocating $253.08 to debt payments can reduce interest over time, improving overall financial health.

- Charitable Giving: Donating $253.08 can positively impact the lives of others while enhancing personal fulfillment.

- Education Investment: Spending $253.08 on courses or workshops can lead to long-term career benefits.

- Travel Opportunities: This amount can fund weekend getaways, enhancing life experiences and personal growth.

- Lifestyle Influence: Individual lifestyle choices shape how $253.08 is perceived and spent, with minimalism allowing for greater utility of this amount.

- Emergency Preparedness: Keeping $253.08 aside for unexpected expenses can provide financial security and reduce stress during emergencies.

FAQs

Q1: What is the significance of $253.08 in personal finance?

A1: $253.08 can represent different financial needs and priorities for individuals. It can be used for budgeting, saving, investing, or addressing debt, making it a versatile figure in personal finance.

Q2: How can I incorporate $253.08 into my monthly budget?

A2: You can allocate $253.08 to essential expenses such as utilities, groceries, or savings for emergencies. Analyzing your budget will help you determine the best use of this amount.

Q3: What are the benefits of saving $253.08 each month?

A3: Saving this amount monthly can lead to significant annual savings, which can be directed towards an emergency fund, retirement savings, or other financial goals.

Q4: How does inflation affect the value of $253.08?

A4: Inflation decreases the purchasing power of money over time, meaning that $253.08 today may not buy the same amount of goods or services in the future as it did in the past.

Q5: Can $253.08 really make a difference in my investment strategy?

A5: Yes, investing $253.08 can grow significantly over time due to compound interest, demonstrating that starting small can lead to substantial wealth accumulation.

Q6: How can I use $253.08 for charitable giving?

A6: Donating $253.08 to a charity can help support causes you care about and can also enhance your sense of fulfillment and well-being.

Q7: What should I do if I have debts?

A7: Applying $253.08 towards monthly debt payments can help reduce the total amount owed and save on interest over time, improving your overall financial health.

Q8: How can $253.08 be used for educational purposes?

A8: Investing $253.08 in courses, workshops, or books can enhance your skills and improve your career prospects, making it a valuable long-term investment.

Q9: What lifestyle choices can affect how I view $253.08?

A9: Your values and lifestyle preferences influence how you perceive and use $253.08, with minimalists finding it more valuable in fulfilling their needs compared to those prioritizing luxury items.

Q10: How can I prepare for unexpected expenses with $253.08?

A10: Keeping $253.08 aside as part of an emergency fund can help cushion the financial blow from unexpected expenses, providing security and peace of mind.